The Shoeboxed Blog

Entrepreneurship, staying organized, DIY accounting, and the latest Shoeboxed news.

Work From Home? Are You Claiming Your $500–$3,000 Home Office Tax Break? 💰

If you work from home (even part-time) and file self-employment or contractor income, you may be leaving $500–$3,000 per year on the table.

Our FREE Home Office Deduction Calculator:

✓ Pulls YOUR property data automatically

✓ Shows simplified vs. actual savings

✓ Generates PDF for your accountant or helps you fill out IRS Form 8829

IRS data shows over 5 million Americans successfully claim the home office deduction. Will you? IRS data

About Shoeboxed - January 6th, 2026

SBA Loan Down Payment: How I Bought a $1M+ Business for 5% Down (And A Warning)

Most people think you need hundreds of thousands in cash to buy a business. I bought Shoeboxed for 5% down using an SBA loan. Here's exactly how the deal worked—the seller financing, the standby note trick, and why the personal guarantee should terrify you. This is the real case study with a full breakdown of how I used an SBA loan to buy Shoeboxed.

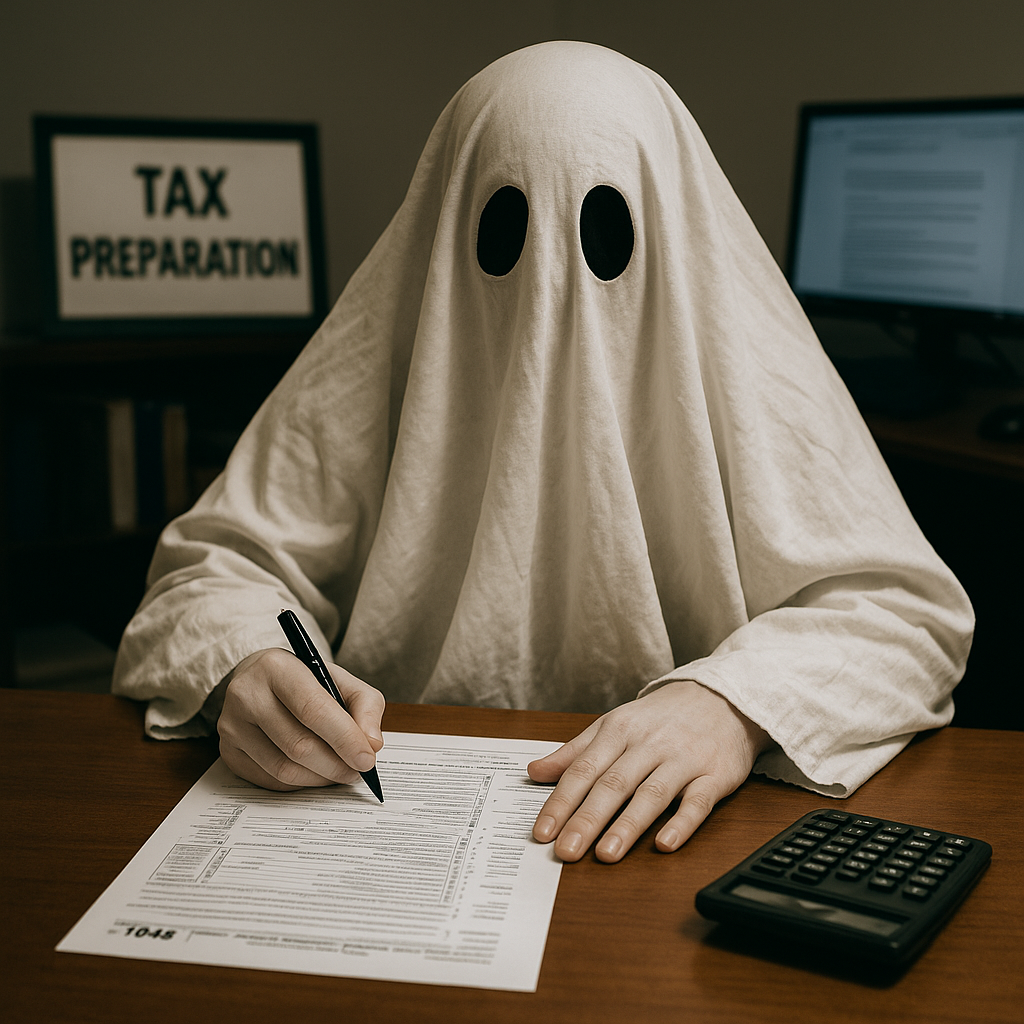

True Tax Crime - November 3rd, 2025

True Tax Crime: The Ghost Tax Preparer of Augusta

When a friendly Augusta tax preparer promised huge tax refunds, no one expected the IRS would call him a ghost, fine him $1M, and send him to federal prison. Dive into the $1M refund scam that fooled a community, and see how a real IRS Enrolled Agent breaks down the mistakes and red flags that alerted the IRS.

Tax Savings - September 5th, 2025