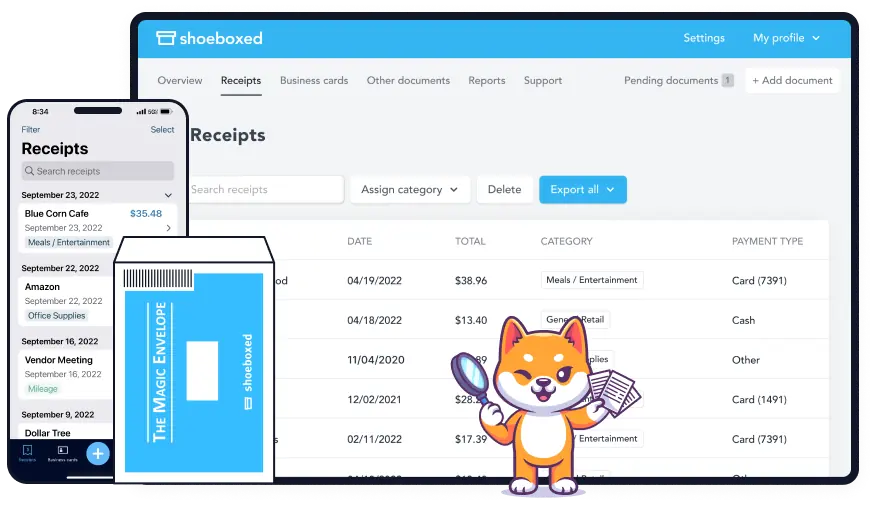

The #1 receipt scanner app loved by over a million businesses

Receipt scanning app or receipt scanning service—your choice.

Simplify daily bookkeeping tasks

WHO USES SHOEBOXED?

Popular use cases for Shoeboxed

Shoeboxed’s digital images of your receipts are accepted by the Internal Revenue Service and the Canada Revenue Service in the event of an audit.

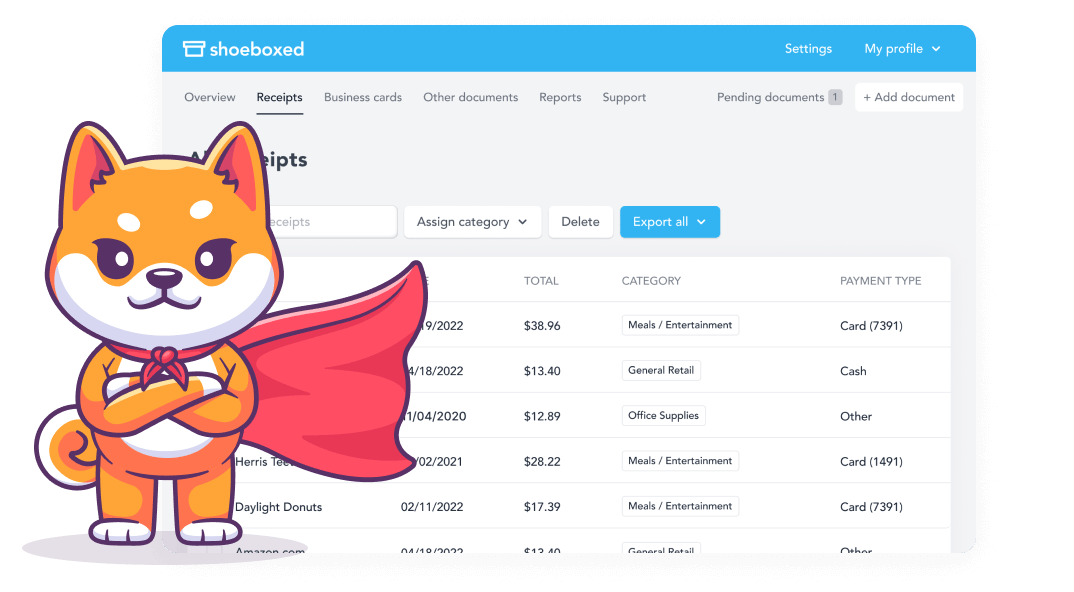

All your scanned receipts are:

- Legibly scanned

- Clearly categorized

- Easy to locate

Receipt organization done right

Try our systematic approach to receipt categories for tax time.

- Important receipt information is OCR-extracted

- Data is automatically categorized into 15 tax categories

- Search, edit & manage receipts quickly for expense reporting

- Create custom reports with receipts attached

- Use the app's free mileage tracker for business mileage

- Add a bookkeeper or accountant as a sub-user for tax reports

- Integrate with other accounting software & accounting tools

- Provide easy access to sub-users for team collaboration

💰 Free Tool: Home Office Deduction Calculator

Work from home? You could be missing $1,500–$5,000/year in tax deductions. Our free calculator pulls your property data automatically and shows you exactly how much you could save.

Calculate Your Savings →*Named best receipt scanner app for tax season by Hubspot!

Use Shoeboxed’s app and scanning service to scan receipts and organize your wallet and office

1. Send in your receipts

2. We extract receipt data

3. Organize & report

Celebrated Illusionist vanishes uncertainty & wasted time with a Magic Envelope

“We now pile all receipts and documents we need scanned and sorted into the magic blue envelopes. We never ever have to see them or think of them again—until we need to, and then it is scanned clearly, sorted, organized, categorized, precisely! It’s impossible to quantify the value, but being that we don’t have to sort, scan, and spend hours searching, Shoeboxed is invaluable!”

Rob Lake

Illusionist on America’s Got Talent, Good Morning America, etc.

Read the full interview

Frequently asked questions

The IRS accepts receipt images as valid tax records provided the receipt scans meet the following criteria: (1) Receipt scans must be identical to their original versions. (2) Each receipt image must be clearly legible and readable. (3) In the case of an IRS audit, you must be able to produce hard copies of the scanned receipts (i.e., hard copies printed from scans). (4) Scanned documents must be stored in a secure place. See “Rev. Proc. 97-22 (Recordkeeping – Electronic Storage System)”, IRS.gov. Shoeboxed fulfills all the requirements for creating an IRS-accepted digital archive of receipts. And all of our receipt scanner plans have no limits on online storage.

The best receipt scanning apps prioritize security and data privacy. We recommend people read the privacy policy and terms of use before using any receipt scanning software. Shoeboxed protects both your paper documents and your scanned documents. All of your paper is securely stored at our processing center in Durham, NC. All doors are entry controlled and monitored 24/7 with security cameras. Digital documents and data are protected by Secure Socket Layer (SSL) encryption, which online banks also use to protect bank accounts. A user can request that documents be shredded after scanning or returned to them.

Optical character recognition (OCR) describes software that allows a computer to read text captured on an image. This means we can extract receipt line items on an image and convert it to text. That data can then be added to fields in accounting software or digital filing systems. To choose the best receipt scanners, double-check that the receipt scanner has this feature.

Shoeboxed uses OCR technology to extract information—but goes a step further by human-verifying all extracted data. Our data entry specialists check every scanned receipt for errors to verify the accuracy of the extracted data. This is one of Shoeboxed's much-loved receipt scanning features and a premium service we include in all of our subscription plans.

Over the years, we have heard directly from our users about the benefits of Shoeboxed’s receipt scanning

software and have documented our customers' success stories in the

case studies

you can find on our site.

In these interviews with our customers, they describe the following benefits of being able to save and

capture receipts in digital format.

- For dispute resolution—When your clients, customers, or users dispute the cost of an item or transaction, you can easily process their claim by pulling up the receipt online in your Shoeboxed cloud storage.

- For tax purposes, claiming tax deductibles on business expenses—Shoeboxed provides you with a powerful mobile app that makes tracking expenses "stupid simple"—according to PCmag.com. Shoeboxed's unlimited storage means you can keep all your receipts, business records, and legal documents in one place. So when you file taxes, you won’t pay a penny more than you need to.

- For monitoring supply costs—Small businesses can get on top of expense management by observing changes in the cost of goods and services, week over week or month over month.

- For monitoring tax liability—Receipt data connected to your accounting software makes it easier than ever to know how much money you should put aside for taxes.

- For proof in case of an IRS audit—Verify all your transactions, invoices, and payments by digitizing every tax document and placing it all in your Shoeboxed account.

- For reimbursing employees’ expenses—Corporate credit cards can help track business expenses for teams, but for businesses without that arrangement, there’s an easier way of collecting physical receipts. Add team members as a user to your Shoeboxed account for no-fuss expense tracking.

- For analyzing spending patterns—Easily and directly track transactions, expenses, the cost of goods, and invoices.

Absolutely! All plans come with a 30-day, 100% money-back guarantee. During this period, you can upload receipts to test how Shoeboxed extracts information and verifies that data with our data-processing team.

Sign up for a monthly or annual plan, and your card gets charged right away. Try everything—upload receipts, test our data extraction, see how it all works. If it's not the right fit, contact us within 30 days and we'll refund you completely.

The only exception: if you request Magic Envelopes and physical document scanning during your trial, we ask that you don't request a refund (we've already incurred those processing costs).

Do you have a year to several years' backlog of paper receipts? Perhaps you need them all digitized for an upcoming tax audit? We'd be happy to help!

We recommend using our pre-paid Magic Envelope service to ship your receipts to our processing center, where we scan receipts into your account and verify each receipt's data. This is a service that Evernote receipts, Neat receipts, and others in this space do not provide.

The Starter plan is perfect for solo users and lets you send us 20 paper scans per year with 1 Magic Envelope at signup.

The Pro plan gives you 240 paper scans per year (60 per quarter) with 1 Magic Envelope each quarter.

The Plus plan lets users send in 600 paper scans per year (50 per month) with 1 Magic Envelope per month.

For businesses processing lots of paper receipts, our Paper Plus plan includes 2,400 paper scans per year (200 per month) with 2 Magic Envelopes per month - perfect for high-volume paper receipt processing.

The Pro and Plus plans include accounting integrations with QuickBooks Online and Xero. All plans come with unlimited digital storage. We also offer significant discounts when billed annually (11-19% savings).

Yes! Users can export receipts to Wave, Evernote, Neat, Zoho Expense, and other accounting software. The Pro and Plus plans integrate with QuickBooks Online and Xero, which are among the most-used accounting software options.

Of course! We go beyond what the best receipt scanner apps offer by scanning any type of document you send in. This is a service that other receipt scanning apps, such as Wave, Evernote, Neat, Zoho Expense, etc., do not offer.

To prepare a single-page document for our document scanner, remove staples and attached sticky notes. To prepare a multi-page document for our document scanner, use a paper clip to attach them together, and our receipt scanner team will scan them into your user account as one document. Read more about multi-page documents here.

The Starter plan is $9 per month ($97/year with 11% savings) and perfect for solo users just getting started. You get 30 digital scans per month (360/year), 20 paper scans per year, 1 Magic Envelope at signup, and unlimited users.

The Pro plan is $29 per month ($297/year with 17% savings) and ideal for freelancers and growing SMBs. Most Shoeboxed users land here. This plan includes 200 digital scans per month (2,400/year), 60 paper scans per quarter (240/year), 1 Magic Envelope each quarter, unlimited users, and accounting integrations with QuickBooks Online and Xero.

The Plus plan is $79 per month ($797/year with 19% savings) and best for small teams needing monthly Magic Envelopes. It includes 750 digital scans per month (9,000/year), 50 paper scans per month (600/year), 1 Magic Envelope per month, unlimited users, accounting integrations, and priority support.

The Paper Plus plan is $179 per month ($1,997/year) for companies that still process lots of paper receipts. It includes 500 digital scans per month (6,000/year), 200 paper scans per month (2,400/year), 2 Magic Envelopes per month, unlimited users, and all premium features.

All plans include unlimited file storage, allowing you to use Shoeboxed as your dedicated document management system. Save 11-19% when you pay annually!

Our receipt scanner app includes the following scanning and expense management features that make it easier to save time, work remotely, and more:

- Mail-in scanning service

- OCR scanning

- Human data verification of OCR scans

- Receipt scans that satisfy the criteria for a tax audit

- Quick totaling of categories

- Expense management for business expenses

- Unlimited users on your account

- Digital image archive

- Document management system

- Unlimited cloud storage of scanned paper documents, digital documents, digital receipts, smart receipts, paper receipts, etc.

- Customizable receipt category tags and rules

- Export receipt data to well-known accounting software

- Track mileage for free for iOS users and Android users

- Store and organize business cards

- iOS and Android mobile app

- A setting to automatically convert currencies

- 24/7 monitoring of entry points at our processing facility for physical receipts & documents

- Digital documents and data are protected by Secure Socket Layer (SSL) encryption, the same level of protection used to safeguard your bank account

- Save 11-19% when billed annually

These features make Shoeboxed's receipt scanning app one of the best receipt scanner options on the market.

Yes! Our plans allow an unlimited number of users for each account. For example, if you have a team and would like to track their expenses in one space, you can add each team member as a user, simplifying expense recording and sending receipts. Or, if you want your bookkeeper or accountant to have access so they can manage your receipts and create expense reports, you can add them as a user to your account as well. In fact, for that very reason, Shoeboxed is the best receipt scanner app for bookkeepers and accountants who are managing clients’ receipts. Account sharing allows for easy client meeting check-ins. Please note that all receipts uploaded in the account are visible to all users listed on the account. Shoeboxed will automatically track who uploaded the receipt. If you’d like receipt data to remain private to individuals uploading and your accounting team, talk to our team about setting up a custom account with customizable privacy settings.