The last thing on your mind when you're out there on the road trying to get in as many deliveries as you can of food or people for the day is keeping track of your mileage.

However, tracking mileage for Uber or Uber Eats drivers is crucial because it can put more money back into your pocket.

Fortunately, several mileage tracker apps are available for Uber drivers to make this process quick and easy.

What are the best mileage tracking apps for Uber Eats drivers?

Here's a look at four of the best apps we have found for Uber mileage tracking.

1. Shoeboxed - Best mileage tracking app for comprehensive expense management

Crowned the “#1 best receipt tracking app” of 2024 by Forbes and given the Trusted Vendor and Quality Choice awards by Crozdesk, Shoeboxed is at the top of the list for its mileage and expense management features.

Shoeboxed is a mileage and expense tracking app that takes your mileage and receipts for other expenses and turns them into digital data for reimbursements, expense reporting, tax prep, and more.

One of the best features of Shoeboxed is that the platform can be used as a receipt-scanning app or service.

Mileage tracker

Shoeboxed is an impressive Uber mileage tracker app that makes manually tracking your mileage easier than ever.

After you sign up for Shoeboxed, you can start tracking miles in seconds:

Open the Shoeboxed app.

Tap the “Mileage” icon.

Click the “Start Mileage Tracking” button.

And drive!

Shoeboxed tracks your location and miles whenever you start driving and saves your route as you drive.

You can drop pins to make tracking more precise as you make stops at restaurants or to pick up passengers.

At the end of a drive, click the “End Mileage Tracking” button to create a trip summary. Each summary will include the date, editable mileage and trip name, and your tax-deductible miles and rate information.

Click “Done” to generate a receipt for your drive and get a photo of your route on the map.

Shoeboxed's mileage tracker app will automatically categorize your trip under the mileage category in your account.

Shoeboxed's mileage feature makes it easy to claim deductions during tax season with the miles you log.

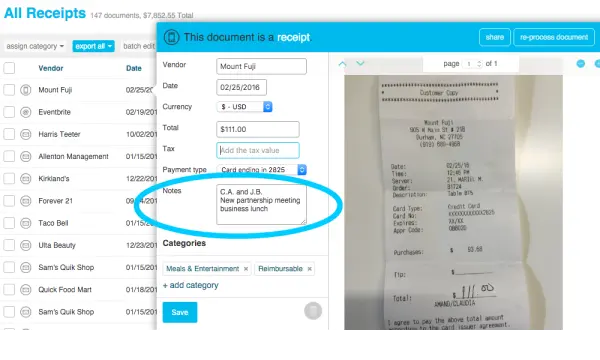

Trip details can be added in 'notes.'

Another great feature is that you can go into Shoeboxed's app and add trip details under the notes section with each mileage receipt, which can be edited whenever needed.

Track mileage with Shoeboxed 🚗

Track mileage using your phone’s built-in GPS for unmatched ease and accuracy. 💪🏼 Try free for 30 days!

Get Started TodayMobile app

Shoeboxed tracks your miles and manages other expenses that Uber drivers can use as tax write-offs.

With the app, you can simply snap photos of the receipts you get from parking, tolls, insulated bags, and vehicle expenses incurred while working.

Shoeboxed will digitize and automatically organize them under 15 tax categories.

The tax categories are editable; add tags and descriptions for each expense to further categorize your purchases.

Shoeboxed also has advanced search and filters to sort and find receipts based on date, vendor, payment type, and more.

The Magic Envelope

You can use Shoeboxed as a service and outsource your receipt scanning with their Magic Envelope.

As a driver, you probably generate a lot of receipts from parking and tolls.

Uber doesn’t reimburse these expenses, but they are tax deductible—and the last thing you want to lose is a tax receipt.

When you buy a plan that includes the Magic Envelope, Shoeboxed will send you a postage-pre-paid envelope each month to mail your receipts.

The Magic Envelope allows drivers to keep track of fuel costs and expenses while on the road. Drivers can keep the envelope on their car dashboard and fill it with receipts as they pay for gas, meals, etc.

Once your receipts reach Shoeboxed’s scanning facility, they’ll be scanned, human-verified, and uploaded to your account under the tax categories (or specific categories of your choosing).

Hit the road with Shoeboxed 🚗

Stuff receipts into the Magic Envelope while on the road. Then, send them once a month for scanning. 💪🏼 Try free for 30 days!

Get Started TodayExpense reports

When it’s tax season, you can use Shoeboxed’s expense reporting feature to create a detailed report of your Uber expenses (including your mileage log) for your accountant.

Shoeboxed’s expense reports come with receipts attached, so you always have proof of purchase for your business expenses.

Integrations

Shoeboxed seamlessly integrates with significant accounting software and bookkeeping platforms, such as QuickBooks, enhancing the overall workflow for financial management.

This integration allows for real-time, monthly income and expense tracking and financial reporting, which can be more cumbersome when using spreadsheets that require manual updates and imports.

IRS-compliant logs

Shoeboxed ensures that all mileage logs comply with IRS standards, making them valid for tax reporting purposes. This compliance is crucial for users who rely on accurate mileage tracking to claim business expense deductions on their tax returns.

Pros:

Easy-to-use Uber mileage tracker app with a user-friendly interface.

Combines receipt and mileage tracking, which is excellent for overall expense management.

Offers robust features for digitizing receipts that are IRS compliant.

Digital storage for receipts makes it easy to track expenses and mileage in one place.

Direct integration with accounting software like QuickBooks.

The mileage tracker saves your route as you drive.

Drivers can edit and add trip details.

Miles are turned into digital data for tax reporting and auto-categorized under mileage.

Filter your receipts for mileage and other business expenses to make tax time easier.

Snap photos of receipts for expenses without stopping the mileage tracker.

The organized PDF and CSV file expense reports with images of receipts are attached.

Outsource your receipt scanning with the Magic Envelope.

Add unlimited free sub-users to your account (such as your accountant).

Cons:

The mileage tracker is manual only, so the app won’t automatically log your drives. However, this makes it easier to separate personal from business trips on your mileage log.

Pricing:

Start-up – $18/month

Professional – $36/month

Business Plan – $54/month

Visit Shoeboxed’s pricing page to learn more about what all of the Digital + Magic Envelope plans offer.

2. MileIQ - Best mileage tracking app for customized options

MileIQ is a popular mileage tracking app designed to help independent contractors, freelancers, small business owners, and anyone else who needs to keep an accurate mileage log of their driving for tax deductions or business expense reporting.

Automatic mileage tracking

MileIQ uses automatic drive detection technology to capture every trip without user intervention. Once installed on your smartphone, the free app then runs in the background, using the phone’s GPS to automatically detect when you are driving.

The downside of the GPS constantly running in the background is that you must manually separate your business and personal miles.

Classification of drives

After each drive, you must classify it as business or personal with a swipe right for business or left for personal.

Detailed drive logs

MileIQ provides mileage logs for each trip, including the date, time, distance, start and end locations, and the purpose of the trip.

Customization of drives

You can customize the app by setting work hours, adding specific locations as frequent starting points or destinations, and creating custom categories for specific types of drives (e.g., Uber meetings and supply runs).

Reports generation

MileIQ allows users to generate mileage reports. These reports can be downloaded as PDF or CSV files.

Integrations

The app integrates with popular accounting and financial management tools and platforms.

Cloud-based data syncing

All mileage data is stored securely in the cloud.

Pros:

Accuracy: Automatic tracking reduces the risk of human error in manual logging. However, it doesn't give you much control over what is logged.

IRS compliance: Reports and logging meet the IRS documentation requirements.

User interface: MileIQ is known for its intuitive and easy-to-use interface.

Cons:

Battery usage: Like any GPS-based app, MileIQ can consume significant battery life.

Limited expense tracking: Lacks integrated expense tracking outside of mileage.

Privacy concerns: Some users may have privacy concerns with constant background tracking.

Subscription cost: While MileIQ offers a free version, it limits the number of monthly trips you can log. Unlimited trip logging requires a paid subscription.

Not as convenient: The automatic detection of drives means that you must constantly separate business from personal miles.

Pricing:

Free version that tracks up to 40 drives per month.

Unlimited tracking for $4.99/month.

3. Everlance - Best mileage tracking app for multiple gig tracking

Everlance lets delivery drivers track Uber mileage and the business miles they spend working for other companies, such as Lyft, DoorDash, and Grubhub. Drivers can choose to track their miles manually or automatically using Google Maps to track their location.

The biggest downside to Everlance is that you only get 30 free trips with the free version, so you’ll have to upgrade to Premium pretty quickly.

Expense tracking and taxes

With Everlance Premium, you’ll not only be able to track your miles, but you’ll also get access to expense tracking and tax help.

To track your expenses with Everlance, sync your bank or card to your account or manually add an expense with a photo of the receipt.

Regarding taxes, Everlance calculates the estimated tax deductions for the miles you’ve driven and creates expense reports for your accountant during tax season.

Pros:

Automatic and manual tracking.

Classifies drives as personal or work-related.

Keeps track of your business expenses and uploads photos of receipts.

Get mileage deduction estimates.

Generate expense reports for tax time.

Cons:

Only 30 free trips without the Premium version. Other apps track unlimited miles for free.

Receipt-scanning leaves a lot to be desired.

Pricing:

Free.

Premium: $5/month (billed annually).

Premium plus: $10/month (billed annually).

4. TripLog - Best mileage tracking app with multiple mileage tracking options

TripLog is a comprehensive expense and mileage tracker app designed for individuals and businesses who need to keep detailed logs for reimbursement, tax deductions, or accounting purposes.

Here's an overview of TripLog and its key features:

Automatic mileage tracking

TripLog provides several automatic trip-start options, including plugging into power, app launching, Bluetooth connectivity, and TripLog Drive, a dedicated GPS device for consistent tracking using Google Maps.

MagicTrip™ is a feature that automatically detects when the vehicle starts moving, capturing every mile without manual input.

Expense tracking

Users can log all expenses related to their business travels, including fuel, parking, tolls, meals, and accommodation.

The app lets you photograph and store receipts digitally, linking them to specific trips for organized record-keeping.

IRS compliance

TripLog generates mileage logs that comply with IRS requirements, ensuring users can confidently use them for tax purposes.

The app helps users calculate tax deductions based on their logged mileage and expenses.

Real-time vehicle tracking

TripLog offers real-time vehicle tracking solutions that are ideal for businesses that are managing multiple drivers.

Reporting and analytics

Users can generate detailed reports on mileage, trips, and expenses, which can be customized and exported in various formats, including PDF and CSV.

TripLog provides analytics that helps businesses analyze operational efficiency, cost management, and driver performance.

Integration

TripLog integrates with accounting software like QuickBooks, Xero, and Concur.

Pros:

Versatility: Suitable for independent contractors, small businesses, and large fleets.

Comprehensive tracking options: include manual to fully automated tracking and expense management.

Reliable IRS compliance: Ensures that the mileage logs meet the strict documentation standards required by the IRS.

Cons:

Complexity: Some may find the array of features and settings overwhelming, particularly if you want to track your miles.

Cost: While a free version exists, full access to all features requires a subscription, which might be more expensive than basic mileage trackers.

Pricing:

TripLog offers a tiered pricing structure to cater to different user needs, starting with a free version for basic manual tracking. Paid plans, which provide additional features like automatic tracking and advanced reporting, start at $4.99 monthly for individuals, with more comprehensive plans available for businesses and fleets.

Why would an Uber driver need additional tracking?

While Uber mileage tracks are helpful for record-keeping related to deliveries, they may not capture all the mileage you could claim for tax deductions. For this reason, many drivers use additional apps to track their mileage and other expenses more comprehensively.

What if I forgot to track mileage?

If you forgot to track your Uber mileage, you can still take a few steps to estimate your mileage for tax purposes.

Review your trip logs from Uber Eats

Uber provides detailed logs of your trips, including the times and dates you were driving and information about each trip's start and end points. You can access these logs through your Uber driver account. These records can help you reconstruct your mileage.

Use online maps

For each recorded trip, use an online mapping service like Google Maps to calculate the distance between the pickup point and the drop-off location. You can also estimate the distance you traveled to reach the pickup location from your previous location.

Create a retrospective mileage log

Once you have all this information, create a comprehensive mileage log:

Date of each driving day.

The estimated mileage for each trip, including additional business-related driving.

A brief description of the purpose of the mileage (delivering food, relocating for more deliveries, etc.).

Use a mileage tracking app moving forward

To prevent this situation from happening again, start using a mileage-tracking app. These apps make the process of tracking miles quick and easy.

Consider professional advice

If you're unsure how to estimate past mileage or if your estimates are significant, consult a tax professional. They can offer guidance on correctly estimating and reporting this information to comply with IRS requirements.

What expenses are tax deductible for Uber drivers?

As an Uber driver, you’re considered an independent contractor, meaning you can claim various tax deductions related to your business expenses. These deductions can significantly reduce your taxable income and your overall tax liability.

Vehicle expenses

There are two methods to determine the mileage deduction:

Standard mileage rate: For 2024, the IRS allows you to deduct 67 cents per mile driven for business purposes. This rate covers costs like gas, depreciation, insurance, and maintenance.

-

Actual expenses: Alternatively, you can track and deduct actual vehicle expenses, including:

Gas and oil

Repairs and maintenance

Vehicle insurance

Lease payments or depreciation

Tire replacement

Registration fees and taxes

Mobile phone and service

Since a smartphone is essential for Uber drivers, you can deduct the portion of your mobile phone purchase and service plan used for business.

Supplies and accessories

Any supplies you purchase for driving with Uber, including car chargers, phone mounts, dash cams, and floor mats, can be deducted.

Car cleaning and maintenance

The costs of cleaning, such as car washes or detailing your car specifically for your Uber driving business, can be deducted.

Tolls, parking, and fees

Any tolls and parking fees incurred while driving for Uber are fully deductible. This does not include parking tickets or fines.

Frequently asked questions

Can I claim mileage for Uber?

As an Uber driver, you can claim mileage as a tax deduction, significantly reducing your taxable income. The IRS allows you to deduct business-related vehicle expenses, including the miles you drive while working.

How do I track Uber miles?

Apps specifically designed for mileage tracking are highly recommended, as they use GPS to track and record all business-related miles accurately. No matter which method you choose, it’s critical to maintain accurate records.

This includes logging:

The date of each driving session.

The mileage for each trip.

The purpose of the trip (e.g., driving to pick up a passenger).

Receipts for all vehicle expenses (if using the Actual Expense Method).

In conclusion

Tracking your mileage as an Uber driver is essential for maximizing your tax deductions, accurately calculating your actual earnings, and making informed decisions about your driving strategies. Each of these mileage-tracking apps offers unique strengths, making them suitable for different users.

Shoeboxed stands out for those who need comprehensive receipts and more accurate mileage tracking and management. The best mileage tracker apps will align with your needs to effectively streamline your expense and mileage tracking.

Caryl Ramsey has years of experience assisting in bookkeeping, taxes, and customer service. She uses various accounting software for setting up client information, reconciling accounts, coding expenses, running financial reports, and preparing tax returns. She is also experienced in setting up corporations with the State Corporation Commission and the IRS.

About Shoeboxed!

Shoeboxed is a receipt scanning service with receipt management software that supports multiple receipt capture methods: send, scan, upload, forward, and more!

You can stuff your receipts into one of our Magic Envelopes (prepaid postage within the US). Use our receipt tracker + receipt scanner app (iPhone, iPad and Android) to snap a picture while on the go. Auto-import receipts from Gmail. Or forward a receipt to your designated Shoeboxed email address.

Turn your receipts into data and deductibles with our expense reports, including IRS-accepted receipt images.

Join over 1 million businesses scanning & organizing receipts, creating expense reports, and more—with Shoeboxed.

Try Shoeboxed today!