Reimbursable expenses have a significant role to play in the business world.

Companies often have an expense reimbursement policy that allows employees to make purchases on behalf of the business. Sometimes, reimbursable expenses are even collected from customers.

But, what exactly are reimbursable expenses, and are there any business-related expenses that can't be reimbursed?

In this guide, we'll cover everything there is to know about reimbursable expenses!

What are the two types of reimbursable expenses?

There are two main types of reimbursable expenses:

Costs for which employers reimburse employees.

Reimbursable expenses made on a customer's behalf.

Both employee reimbursements and reimbursable expenses from customers are commonly used in business.

Let's go over each in more detail below.

1. Employee expense reimbursement

Employee expense reimbursement is the process by which employers pay their employees back for business-related costs purchased with their personal money.

Employers will typically reimburse travel costs, but all business-related expenses made by an employee (such as office supplies, materials, or tools) can be reimbursed at any time.

What is a reimbursable expense?

Meals for breakfast, lunch, and dinner are considered reimbursable expenses for employees on business trips.

A reimbursable expense is any cost purchased by an employee on behalf of the employer that is necessary and ordinary to the business.

Examples of reimbursable expenses include the following:

Work-related supplies: Business supplies purchased by an employee can be reimbursed at cost.

Business travel expenses: The cost of travel for work, including flights or transportation, hotel stays, and meals.

Mileage: If an employee uses their personal vehicle to travel for work, they can be reimbursed at the IRS standard mileage rate.

Meals and entertainment: Funds spent on meals and entertainment are reimbursable if the meal or event is strictly for business purposes.

Medical expenses: Healthcare for employees is required by employers, which means any medical expenses (hospital stays, medication, or treatments) are reimbursable expenses.

Education expenses: Any further education or training required for the position can be reimbursed to the employee.

Reimbursable expenses are typically not considered taxable income by the IRS and may even qualify as deductible expenses for the employer.

2. Reimbursement for business expenses

Though businesses reimbursing employees is the most used reimbursement process, companies can also incur reimbursable expenses on behalf of customers.

These expenses are incurred when the business carries out tasks associated with the customer's project, such as travel or delivery of goods and services.

Reimbursable expenses may also include the following:

Currency conversion fees.

Business calls.

Office or supply expenses.

These types of reimbursements are typically invoiced to the customer upon the project's completion. Which expenses are reimbursable should be communicated to the customer before work begins.

What are reimbursement expenses for?

Reimbursement expenses allow businesses to pay employees back for the business expenses they purchase with their own money.

The reimbursement process benefits businesses by repaying employees the exact amount of a cost rather than estimating the cost with a set allowance (such as for business travel).

Employee expense reimbursements are beneficial for employees because they don't have to worry about losing money from out-of-pocket business expenses. A reimbursement for a business expense will also most likely not be considered as wages or taxable income.

What expenses are not reimbursable?

Though many travel costs are often reimbursed by companies, non-reimbursable expenses may include lost personal property and travel insurance.

Non-reimbursable expenses refer to any purchase of service or goods that does not comply with the company's reimbursement policy.

Non-reimbursable expenses may include the following:

Lost or stolen personal property.

Personal expenses, such as toiletries or clothing.

Excessive costs (eating at expensive restaurants or using room service).

Valet, parking violations, tickets, or fines.

Costs incurred for failure to cancel reservations or transportation.

Childcare and house or pet sitting while you're away on a business trip.

Costs for additional travelers, such as your spouse, including transportation and meals.

Alcohol.

Travel insurance.

What counts as reimbursable expenses varies depending on the company, but typically, employee expenses are not considered business expenses if they're not necessary to the company or the task at hand.

Reimbursement plans for businesses

Business reimbursement policies can cover employee expenses through an accountable plan or a non-accountable plan.

What are accountable reimbursement plans?

To reimburse employee expenses, an accountable plan requires that employees show proof of their business-related expenses (in the form of reimbursement receipts) within a reasonable timeframe, usually up to 60 days from the purchase date.

Accountable reimbursement plans allow businesses to better align with IRS regulations regarding taxable and deductible reimbursements.

This is the most popular type of reimbursement plan for businesses.

What are non-accountable reimbursement plans?

A non-accountable plan is one in which employees fail to prove their expenses are business-related within a specified time period or are not required to return unspent allowance.

Say a reimbursement plan provides $100 for meals each day for business trips but the employee isn't required to show proof of purchase with receipts or return the money they didn't spend.

This arrangement would be considered supplemental wages and is subject to taxation.

This is because there would be no evidence that the money was spent on meals and, therefore, it would be assumed the employee is being paid for business-related activities.

Streamline reimbursements with Shoeboxed

Shoeboxed is trusted by over 1 million users to automate receipt management.

Don't risk losing a reimbursable expense—digitize your employee business expenses with Shoeboxed!

Shoeboxed is an expense management tool that lets you turn your employee expenses into digital data so you never have to keep track of paper receipts or manually input expenses into a spreadsheet again.

Track receipts with the Shoeboxed app

Just snap photos of business expense receipts with the Shoeboxed app to have them turned into digital data and categorized under your account.

When you take photos of your travel expenses, office expenses, lodging costs, or any other receipt for business purposes, Shoeboxed will automatically extract the receipt information and categorize the expense under 1 of 15 tax categories.

You can even create a custom expense category to better manage expenses incurred.

Create detailed, customizable expense reports for your boss

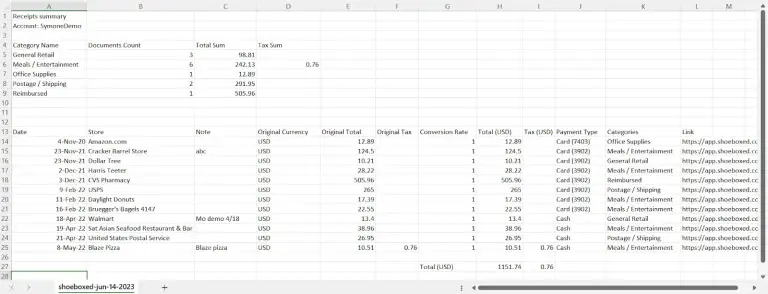

Example CSV expense report from Shoeboxed demo account.

When you're ready to submit your reimbursable payments, just select the receipts you want to include in your expense report and Shoeboxed will generate a detailed report to print, export, or email to your boss.

Shoeboxed expense reports come with images of the receipts attached to every expense should your expense claims be called into question by your employer or the finance team.

Never lose a receipt again ✨

Join over 1 million businesses scanning receipts, creating expense reports, and reclaiming multiple hours every week—with Shoeboxed.

Get Started TodayWhat else does Shoeboxed offer?

1. Unlimited free sub-users

All Shoeboxed plans come with an unlimited number of free sub-users so you can add the appropriate authority to your account to review expenses at no additional cost to you.

2. User-friendly web dashboard

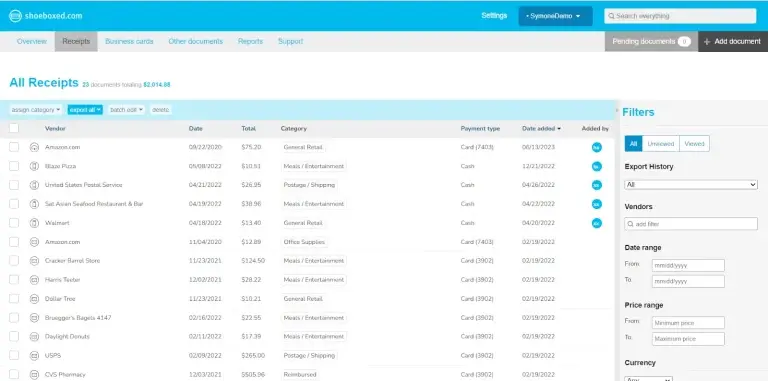

Demo account web dashboard.

Every Shoeboxed plan (except for mobile-only) includes the online web dashboard where you can organize and access your receipts. You can even upload documents from your computer files!

3. Gmail sync

If you opt for digital receipts, Shoeboxed can sync with your Gmail to automatically pull purchases from your inbox.

Like with the app, Shoeboxed will pull the information from the e-receipt, categorize it in your account, and save a virtual image of the expense as proof of purchase.

4. Magic Envelope service

Business trips can leave employees with mounds of paper receipts, which is where the Magic Envelope comes in handy.

Shoeboxed’s Magic Envelope service allows users to outsource their receipt scanning to Shoeboxed.

At the end of your trip, just stuff your receipts inside Shoeboxed’s prepaid Magic Envelope and the team at Shoeboxed will scan, upload, and categorize them for you.

5. Built-in mileage tracker

Shoeboxed also offers a free built-in mileage tracker so you can calculate business mileage right from your phone and include it in your expense report.

You can even snap photos of the receipts you gather along the way without stopping the mileage tracker!

Turn receipts into data with Shoeboxed ✨

Try a systematic approach to receipt categories for tax time. Try free for 30 days!

Get Started TodayFrequently asked questions

What is an example of a reimbursement expense?

Employee reimbursement for office supplies, travel for work, lodging, and meals with clients are examples of expense reimbursement. Employees need to keep track of reimbursable expenses with receipts or else their employer may reject the reimbursement claim.

What are reimbursable expenses in financial statements?

Reimbursable expenses are any cost necessary for the business to operate and function efficiently, such as employee expenses. Business expenses paid with the employee's own money, like work-related meals and entertainment and travel costs, are reimbursed.

In conclusion

Business expense reimbursements are a necessary cog in the wheel of efficient companies.

Employee expense reimbursement refers to businesses paying employees back for costs incurred for things like office supplies or business trip expenses.

Customers may also pay reimbursable expenses for business phone calls, an employee's travel, and other costs related to carrying out a task for customers.

Need a way to streamline employee expense reimbursement? Look no further than Shoeboxed!

Hannah DeMoss is a staff writer for Shoeboxed covering organization and digitization tips for small business owners. Her favorite organization hack is labeling everything in her kitchen cabinets, and she can’t live without her mini label maker machine.

About Shoeboxed!

Shoeboxed is a receipt scanning service with receipt management software that supports multiple methods for receipt capture: send, scan, upload, forward, and more!

You can stuff your receipts into one of our Magic Envelopes (prepaid postage within the US). Use our receipt tracker + receipt scanner app (iPhone, iPad and Android) to snap a picture while on the go. Auto-import receipts from Gmail. Or forward a receipt to your designated Shoeboxed email address.

Turn your receipts into data and deductibles with our expense reports that include IRS-accepted receipt images.

Join over 1 million businesses scanning & organizing receipts, creating expense reports and more—with Shoeboxed.

Try Shoeboxed today!