Don’t pay one cent more than you owe with our five proven tax reduction strategies for small business owners.

Does your small business pay unnecessary payroll taxes?

Is your retirement plan designed to maximize deductions?

Could you be expensing more of your business assets?

Do you want to know how to invest business profits to avoid taxes?

As a small business owner, there isn’t much that you don’t take responsibility for when it comes to your business. You’re the boss; you wear every hat and, whether you like it or not, the buck always stops with you. Both the freedoms and responsibilities that come with owning a business are things you embrace and enjoy. Your business is more than a job—it’s your life. We understand.

If you want to learn about small business taxes for beginners and how to reduce corporate taxes in April, we want to help. The Shoeboxed Team works with hundreds of small business owners every day and fully understands that none of them started their own businesses anticipating the preparation and filing of taxes every April. Taxes are expensive, the tax code is continually changing, and the entire process can become an enormous distraction from the one thing that matters most to you: the success of your business.

In an effort to simplify your life during tax season, Shoeboxed has teamed up with Stancil & Company CPA to give you proven tax planning strategies for companies to ensure you’re not paying one dime more than you should in taxes.

In this white paper, you’ll find five time-tested and proven tax reduction strategies for small business owners to reduce the tax burden on your small business.

1. Contribute to retirement plans

Contributing to your retirement plan is one of the best tax-saving strategies for high-income earners and business owners. Considered by far the best option for all taxpayers to save on taxes, it’s recommended that small business owners pay themselves first.

Depending on the type of business and type of retirement plan, a business owner could put anywhere from $50,000 to $100,000 in a retirement plan and receive this deduction immediately. A few of these tax-free contribution options include:

Simple IRA

Roth IRA

403(b)

Simplified Employee Pension Plan (SEP)

Retirement plans are the best method to reduce taxes simply because you’re building up your retirement account in the long run while saving on taxes in the short term. If you haven’t already, we highly recommend contacting your CPA professional to find the best retirement plan for your business.

2. Expense asset purchases

Outside of contributing to retirement plans, expensing asset purchases is probably the most popular method of reducing the tax burden on small businesses. Business owners will need to make a large asset purchase at some point in the course of normal business operations, and the IRS allows a deduction of the entire amount of this item at the time of purchase (up to certain limits). As discussed previously, we stress that businesses should only spend money on necessary items, rather than simply to alleviate taxes.

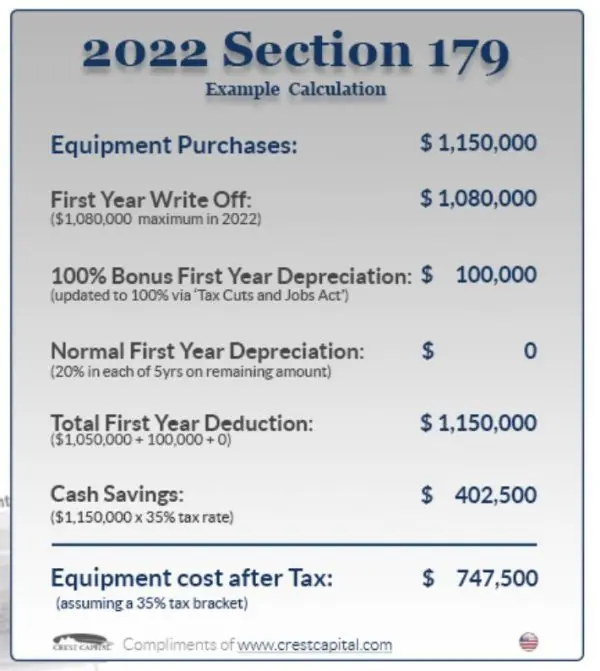

Sample Section 179 calculation by Crest Capital.com

The Internal Revenue Code Section 179 deduction allows businesses to expense the full purchase price of a qualifying item within the tax year. Limits govern the price that can be expenses with a phase-out threshold in place. Updated laws changed the maximum deduction from $500,000 to $1 million and the phase-out from $2 million to $2.5 million.

Recent laws also expanded the definition of qualifying purchases to include:

Improvement of property, such as improvement to the interior (Note: there are restrictions against enlargements, elevators, escalators, and internal structure framework)

Roofs

HVAC

Fire protection system

Alarms

Security systems

Section 179 deductions are not automatically applied, which means paperwork needs to be filed to claim the correct amounts. IRS form 4562 is the form businesses need to provide the IRS during tax time to claim their purchases.

Turn receipts into data for tax time ✨

Try Shoeboxed’s systematic approach to receipt tracking for tax season. 30-day full money-back guarantee!

Get Started TodayA first-year bonus depreciation is also an option allowing business owners to expense certain assets purchased and placed in service after Sept. 27, 2017, and before January 1, 2023, whether the equipment is new or used. New changes to IRS guidelines, now allows claiming of 100% of the qualified property rather than the 50% allowed before.

Learn how to pay less to the IRS with this webinar from Bench. Sign-up to Bench using this link, and get 50% off your first 6 months!

3. Choose the proper accounting method

Most small business owners operate on a cash method of accounting. This generally means that income and expenses are not recognized for tax purposes until cash actually exchanges hands.

An alternative method of accounting is the accrual method of accounting. Under the accrual method of accounting, income and expenses are recognized when all necessary events have occurred that give the right to payment. In other words, you don’t actually have to make the payment or receive the income to recognize it for tax purposes.

Depending on how your business operates, you should speak with a CPA and decide which accounting method is best for you. Doing so may allow you to defer income and accelerate expenses.

See also: Bookkeeping Resources: 45+ Courses, Tools, Sites, and More!

4. Don’t forget the credits for children

This list of tax reduction strategies for small business owners would not be complete without mentioning the childcare credit—it is also the most common credit that goes unclaimed. This error is caused by the difference in costs eligible for the credit versus the costs eligible to be paid by the employer.

The childcare credit is allowed for the costs of daycare or non-overnight camps that children might attend when both parents have earned income. The IRS allows employers to exempt up to $5,000 of these costs from the employee’s taxable pay as reimbursable costs for daycare.

The childcare credit is great for employees because it can reduce their taxable income; however, many employees forget that the total costs up to $6,000 can be used for the credit. This means that a taxpayer that participates in the employer’s plan to reimburse $5,000 in daycare costs can still get a credit base on $1,000 of daycare costs. At the lowest credit rate of 20%, this is a potential $200 loss of credit for the taxpayer. It is worth the time to double-check your daycare costs to see if you can save at least another $200.

See also: Tax Saving Tools: Best Tax Saving Instruments for 2024

5. Elect S status to save on payroll taxes

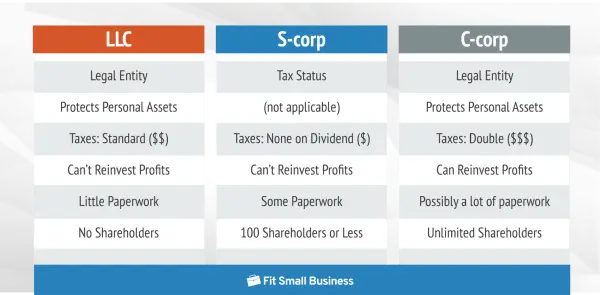

Most small businesses choose one of three ways to organize their organization: a sole proprietorship, an LLC, or an S corporation. For small businesses that have a single owner, we recommend setting up an S corporation due to the way taxes are filed.

Carefully choosing the right corporation option is one of the best tax reduction strategies for small business owners. Chart by FitSmallBusiness.com.

If a single-owner business is a sole proprietorship or an LLC, all of the income is reported on Schedule C of the owner’s personal return. The LLC is used as a throughway; the LLC doesn’t pay any taxes, but rather the owners claim it on their own tax returns. The total taxable income is then subject to Social Security and Medicare (FICA payroll) taxes in excess of 15%.

However, if the owner forms as an S corporation, the owner can pay himself or herself a reasonable salary. The key term is reasonable. The IRS considers a salary to be reasonable if it is the same amount that would be paid to someone hired to do the owner’s job.

If the salary is reasonable, then the owner only pays Social Security and Medicare taxes on the salary portion. If any profits remain after paying the owner’s salary, this income is not subject to payroll taxes.

Thus, a taxpayer could save up to 15.3% on the net profits in excess of their salary from the S corporation.

For example, let’s assume that Eve owns Company X as a sole proprietorship and that Company X has $100,000 of income. On her personal return, Eve would have to pay FICA payroll taxes on $100,000 of the earnings of Company X, whether she paid herself or not. Assuming a rate of 15.3%, she would have to pay $15,300 of self-employment taxes on her personal return.

Alternatively, if Company X were an S corporation, Eve would be required to pay herself a salary for the type of job that she performs for the company. If the normal salary for the job that she performs at Company X is $75,000, she and the company would pay payroll taxes at a 15.3% rate, or, in this case, on $11,475. Thus, by electing to be an S corporation, Eve will save $3,825 in payroll taxes.

Disclaimer: Please do not confuse net profits in excess of wages of not being subject to income tax. In both scenarios, the net profits are always subject to regular income tax.

See also: LLC vs. LLP vs. Sole Proprietorship: Choosing a Business Structure and Why It Matters

Break free from paper clutter ✨

Use Shoeboxed’s app and scanning service to scan receipts and organize your wallet and office. 30-day full money-back guarantee!

Get Started TodayFrequently asked questions

What are the 5 proven methods to reduce small business taxes?

What tax credit is often unclaimed?

The childcare credit often goes unclaimed. Confusion often arises over the difference in costs eligible for the credit versus the costs eligible to be paid by the employer. The IRS allows employers to exempt up to $5,000 of these costs from the employee’s taxable pay as reimbursable costs for daycare.

About Shoeboxed!

Shoeboxed is a receipt scanning service with receipt management software that supports multiple methods for receipt capture: send, scan, upload, forward, and more!

You can stuff your receipts into one of our Magic Envelopes (prepaid postage within the US). Use our receipt tracker + receipt scanner app (iPhone, iPad and Android) to snap a picture while on the go. Auto-import receipts from Gmail. Or forward a receipt to your designated Shoeboxed email address.

Turn your receipts into data and deductibles with our expense reports that include IRS-accepted receipt images.

Join over 1 million businesses scanning & organizing receipts, creating expense reports and more—with Shoeboxed.

Try Shoeboxed today!