Meticulously tracking expenses is crucial for accurate tax reporting and compliance. This includes hanging on to all of your receipts.

However, sometimes, you might not have receipts to back up every transaction—whether due to loss, electronic transactions without physical receipts, or simply forgetting to ask for one.

Here's a comprehensive guide to help you maintain proper records claiming expenses, even without receipts.

What can you claim as business expenses?

Various expenses can be claimed to reduce taxable income in business, provided they are both ordinary (standard and accepted in your business) and necessary (appropriate and helpful for your business).

Here are several types of business expenses commonly claimed on tax returns:

Home office expenses

If part of your home is used regularly and exclusively for business activities, you can claim deductions for the percentage of your home used for business. Allowable expenses include a portion of your rent or mortgage, utilities, real estate taxes, repairs, and maintenance.

Equipment and office supplies

Equipment and office supplies include all the small and large items you purchase to keep your business running, from pens and paper to computers and software. Larger purchases like furniture and computers may need to be depreciated over several years.

Travel expenses

Expenses incurred while traveling for business can be deductible. This includes airfare, hotel stays, meals, rental cars, and other costs related to business travel.

Vehicle use

If you use your vehicle for business purposes, you can deduct vehicle expenses using either the standard mileage rate or actual expenses (including gas, maintenance, and depreciation). You must keep detailed records of travel expenses to support your deduction.

Salaries and benefits

Wages, salaries, bonuses, commissions, and taxable fringe benefits you provide employees are deductible business expenses. This also includes contributions to retirement plans and other benefits.

Rent

The cost of renting office space, machinery, equipment, or other items needed for your business can be deducted when filing taxes.

Utilities

Electricity, water, internet, telephone, and other utility expenses directly associated with your business operations are deductible.

Insurance

Premiums for business insurance such as liability, malpractice, workers' compensation, and property insurance are deductible.

Marketing and advertising

Costs incurred in promoting your business and marketing costs, including advertising, public relations, and promotional materials, can be deducted.

Professional fees

Fees paid by a business owner to attorneys, accountants, consultants, and other professionals can be deductible if the fees are paid for work related to your business.

Education and training

Expenses for education and training that enhance your or your employees' skills or are required by law or regulations for your business can be deductible.

Does the IRS require receipts for all business expenses?

While not all business expenses require receipts, according to the IRS, having them on hand is the best practice to avoid complications during an audit. Always back up your expenses with as much documentation as possible to claim tax deductions.

How can I keep track of my business expenses without physical receipts?

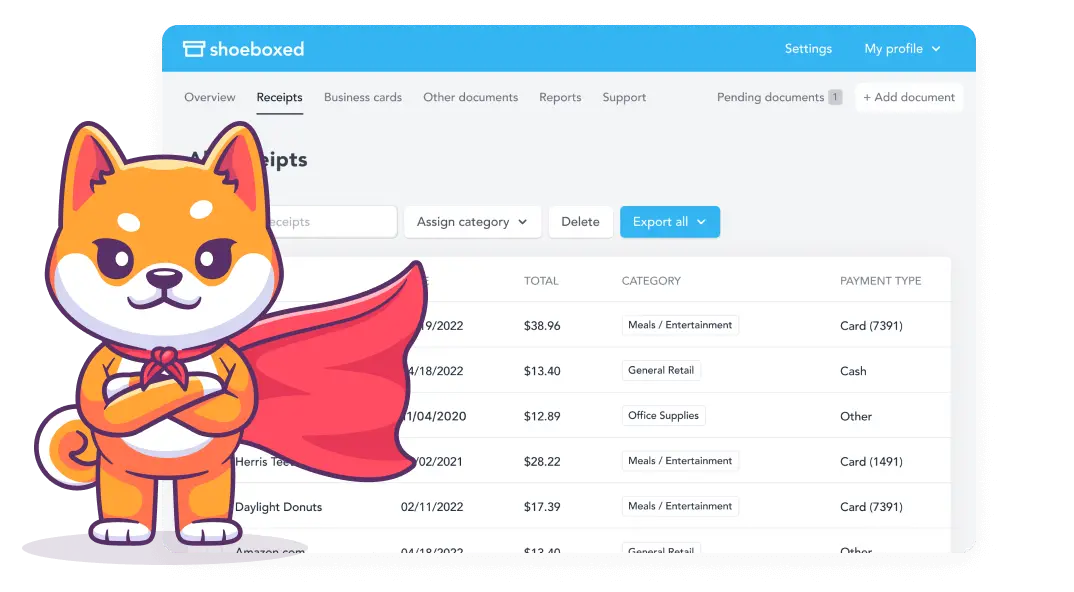

Digital tools can simplify the whole expense tracking process. Apps like Shoeboxed have features to log expenses, so you don't have to hold onto or keep up with physical receipts.

Shoeboxed is an excellent service for recording expenses without having to hang on to physical receipts

Shoeboxed is a valuable tool for expense management, especially for tracking and managing receipts efficiently.

It offers features that simplify tracking and recording expenses for tax purposes or reimbursement without hanging on to the original receipt.

Digital receipt management

Shoeboxed allows you to digitize, organize, and categorize receipts electronically. You can use the Shoeboxed app and snap a picture of your receipt with your smartphone's camera. The app then extracts critical data from the digital image, such as the amount, date, and vendor.

Handling email receipts

Shoeboxed can also manage electronic receipts. Shoeboxed manages emailed receipts primarily through its Gmail integration, which is designed to automatically extract receipt information directly from your Gmail account.

Shoeboxed has a feature specifically for Gmail users that automates receipt management. Once you link your Gmail account to Shoeboxed, the system scans your emails to identify those containing receipts.

The software automatically pulls receipts from your emails and imports them into your Shoeboxed account. This includes receipts embedded in the subject line or body of the emails and those attached as PDFs, images, or other document formats.

Mileage tracking

For expenses that don't typically involve a receipt, like mileage, Shoeboxed offers a feature to track mileage through their app. You can log trips, auto-categorize your business expenses, and calculate the deductible amount based on the standard IRS mileage rate.

Track mileage with Shoeboxed 🚗

Track mileage using your phone’s built-in GPS for unmatched ease and accuracy. 💪🏼 Try free for 30 days!

Get Started TodayMagic Envelope service

Shoeboxed's Magic Envelope service is beneficial for nipping the problem of losing receipts in the bud. You can place all your physical receipts in a prepaid envelope and send them to Shoeboxed. They’ll scan and digitize these receipts, extracting relevant data for your records.

Since you can keep this envelope with you, for example, on your car dashboard, you can fill it with gas or meal receipts before pulling out of the parking lot, which means at tax time, there will be no more lost or damaged receipts!

This service ensures that all physical receipts are also converted into digital form, which can be helpful if the original receipt is lost or damaged.

Never lose a receipt again 📁

Join over 1 million businesses organizing & scanning receipts, creating expense reports, and reclaiming multiple hours every week—with Shoeboxed.✨

Get Started TodayIntegration with accounting software

Shoeboxed seamlessly integrates with accounting software like QuickBooks, Xero, and others. This integration helps maintain continuity and accuracy in financial reporting, making it easier to manage expenses, as all data is consolidated, consistent, and easily accessible for either tax return preparation or audits.

IRS compliance

The IRS accepts the digital images of receipts created by Shoeboxed. Each digitized receipt includes all necessary details, such as the date, amount, and merchant, ensuring compliance without physical receipts.

Shoeboxed effectively reduces the hassle of keeping up with physical receipts while ensuring all expense records are thorough and IRS-compliant. It offers a streamlined solution for managing and recording expenses digitally.

How do you claim business expenses without receipts?

The goal is to claim deductions without involving tax authorities such as IRS auditors. However, you can do the following if you are questioned and need proof without a receipt.

1. Use bank and credit card statements

Your bank and credit card statements can be substantial proof of purchase for many expenses. They provide a reliable documentation trail directly linked to your financial institutions.

What to do: Regularly download or collect monthly credit card or bank statements. Highlight or annotate business expenses.

Tip: Please make sure your statements include the date, merchant name, and amount spent since this information is essential for tax purposes.

2. Maintain a detailed log

Creating and updating a detailed log of your expenses can compensate for the absence of receipts. This is particularly useful for cash transactions or when electronic receipts are unavailable.

How to maintain: Log expenses using a spreadsheet or a specialized app like Shoeboxed. Include the date, amount, purpose, and party paid.

Best practices: Update this log regularly, ideally daily, to avoid forgetting or omitting details.

3. Use digital tools and apps

Digital tools and apps can simplify expense tracking. Apps like Shoeboxed come with features to log expenses and categorize them, which can be helpful during tax season.

Benefits: Many apps allow you to capture information at the point of sale, some even directly from bank or credit card feeds.

Recommendation: Choose an app that syncs across all devices to keep your data consistent and accessible.

4. Obtain duplicate receipts

Whenever possible, request duplicates of lost receipts. Many businesses can provide electronic copies of original receipts, mainly if you use a credit card for the transaction.

Procedure: Contact the vendor with the transaction details and request a duplicate receipt. For online purchases, check your email, as electronic receipts are often sent upon purchase completion.

5. Keep relevant correspondence and contracts

For services or more significant business transactions and expenses, saved emails, contracts, written records, or written agreements can serve as proof of the transaction.

Document: Keep a folder (digital or physical) with all related correspondence, contracts, or service agreements that detail the nature and cost of the transaction.

6. Take photographs and screenshots

In the digital age, a quick photo or screenshot can serve as proof of expense, especially for online transactions or in cases where a physical receipt is impractical.

How to use: Snap a picture of the service or product and pair it with a bank statement entry if available. Ensure the context indicates the expense's purpose and relevance to tax deductions.

7. IRS compliance and best practices

While the IRS prefers receipts for documenting deductions, they accept other forms of documentation as long as they clearly and accurately depict the expense and its business purpose.

Advice: Always provide as much detail as possible with each recorded expense. In the case of an audit, detailed records can often suffice if receipts are not available.

Frequently asked questions

Can I claim a business expense without a receipt?

Having receipts on hand is the best practice to avoid complications during an audit. However, using credit card statements, maintaining a log with detailed notes, or using digital tools or apps such as Shoeboxed can be sufficient alternatives. It's essential to always back up your expenses with as much documentation as possible to claim tax deductions.

Can bank statements serve as proof of purchase?

Bank statements, cancelled checks, and credit card statements are good starting points to claim expenses without receipts. If you have separate accounts for personal expenses and business expenses, this makes it even easier to review bank statements for business transactions without a receipt.

In conclusion

If you claim expenses without receipts, it can be a challenging but feasible process with meticulous record-keeping and modern tools such as Shoeboxed. Ensure that you document every detail that can verify the expense and its purpose. After all, the goal is to reduce your tax bill as much as possible. This proactive approach will help during tax season and enhance your overall financial management.

Caryl Ramsey has years of experience assisting in different aspects of bookkeeping, taxes, and customer service. She uses a variety of accounting software for setting up client information, reconciling accounts, coding expenses, running financial reports, and preparing tax returns. She is also experienced in setting up corporations with the State Corporation Commission and the IRS.

About Shoeboxed!

Shoeboxed is a receipt scanning service with receipt management software that supports multiple methods for receipt capture: send, scan, upload, forward, and more!

You can stuff your receipts into one of our Magic Envelopes (prepaid postage within the US). Use our receipt tracker + receipt scanner app (iPhone, iPad and Android) to snap a picture while on the go. Auto-import receipts from Gmail. Or forward a receipt to your designated Shoeboxed email address.

Turn your receipts into data and deductibles with our expense reports, including IRS-accepted receipt images.

Join over 1 million businesses scanning & organizing receipts, creating expense reports, and more—with Shoeboxed.

Try Shoeboxed today!